Agricultural outlook for Q1 2026 from Terrain™, our service for agricultural insights. Author Matt Erickson is Terrain’s senior analyst focusing on macroeconomics and the grain, oilseed and swine sectors. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation

U.S. pork exports are down over 3% year to date, but growth in exports to Latin America — led by Mexico — has helped offset declines elsewhere. Mexico’s demand remains critical, and U.S. exports are poised for support in 2026 amid uncertainty over Spain’s African swine fever outbreak. Despite heavier slaughter weights lowering hog prices, producer margins have stayed positive.

Outlook

Tight pork supplies and low cold storage levels are supporting prices, but hog weights above their seasonal trend could pressure the hog markets in Q1. Producer margins are expected to remain resilient in 2026, but profitability will be slightly lower than 2025 levels.

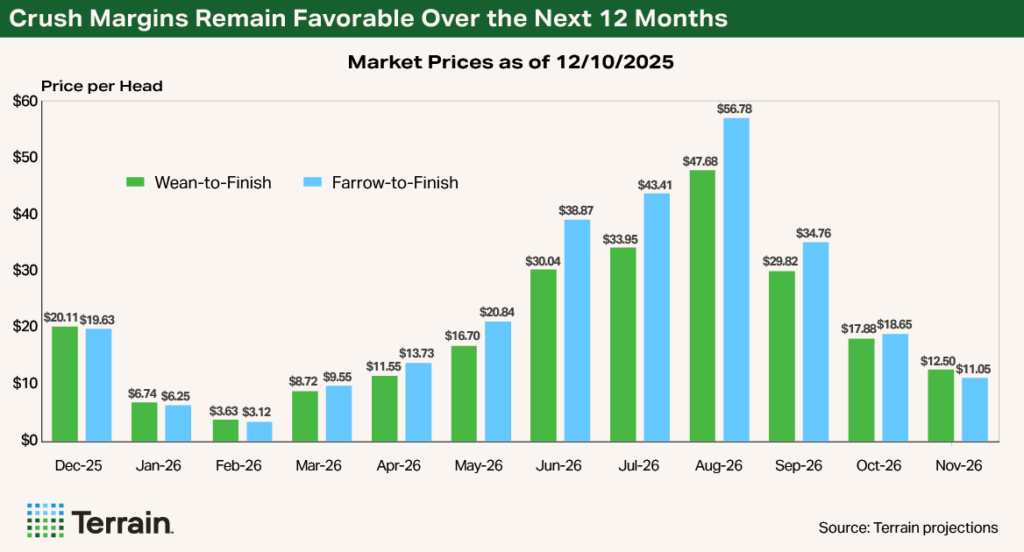

Lower-than-average feed costs are supporting hog producer margins, which remain positive after two years of tight margins following the 2023 downturn. This much-needed relief is allowing producers to strengthen their financial positions. While the outlook for profitability over the next 12 months is favorable, producers should remain proactive in risk management to protect margins through 2026.

Margins remain well above seasonal averages.

Long Stretch of Profitability

Omaha cash corn prices have risen 15% since mid-August but, at $4.32/bu., remain 26% below the five-year average. Soybean meal prices have climbed 28% since July, yet at $323.70/ton are still 22% below the five-year average.

Wean-to-finish profits are projected to average over $6/head in Q1.

Estimated returns for a farrow-to-finish operation, calculated by Iowa State University, reached $33.77/head in October, marking 19 consecutive months of profitability, the longest streak since Q2 2013 through early 2015. Margins remain well above seasonal averages, compared with the five-year ($7.19/head) and 10-year ($5.83/head) October benchmarks.

Based on futures prices as of December 10, 2025:

- Wean-to-finish profits are projected to average over $6/head in Q1 2026 and around $20/head over the next 12 months

- For farrow-to-finish operations, profitability is expected to average over $6/head in Q1 2026 and over $23/head across the year

While lower feed costs have eased input pressures, weaned pig prices remain 38% above their five-year seasonal average due to tight supplies and elevated PEDV (porcine epidemic diarrhea virus) levels in October and November.

Tighter Supplies, Heavier Weights Set Stage for 2026

As is typical in fourth quarters, hog prices declined sharply. Over the past five years, monthly liveweight hog prices have averaged $5.35/cwt lower in Q4 than Q3. Over the past 10 years, they have averaged $9.55/cwt lower. The seasonal drop in Q4 2025 reflects increased slaughter numbers and heavier weights driven by cooler temperatures and a bumper U.S. corn crop.

Health pressures, reduced farrowing expectations, tight supplies and limited cold storage should support prices into the new year, though heavier weights may temper gains early in Q1.

Upside Price Risk: Pork Inventories

Cold storage stocks remain tight. With the government shutdown delaying updates, the latest USDA data (August 31, 2025) showed pork inventories at 393.9 million pounds — down 2.7% from July and 17.5% below the five-year average, marking the lowest August since 2010. This constrained supply continues to support elevated prices.

Upside Price Risk: Swine Health

Health challenges also weigh on the industry. PRRS-positive (porcine reproductive and respiratory syndrome) cases rose from 24.99% in October to 27.85% in November, slightly above the five-year average. PEDV cases rose from 5.16% to 9.9%, driven by higher positivity in the wean-to-market category, which jumped from 9% to over 17% month over month.

Heavier weights suggest more pork will reach the market in Q1.

Downside Price Risk: Weights

Year-over-year (YOY) hog slaughter is 3.8% higher, though year-to-date (YTD) slaughter remains 1% below 2024 and 0.2% below 2023. Weights, however, have risen above seasonal trends. Producer-owned barrow and gilt weights are up YOY, by 1.6% nationally and 1.6% across Iowa, Minnesota and South Dakota, while packer-owned weights are up 1.2% and packer-sold weights are up 1.6%, adding downward pressure on prices. These heavier weights suggest more pork will reach the market in Q1.

Though Steady, Exports Lag 2024 Record Pace

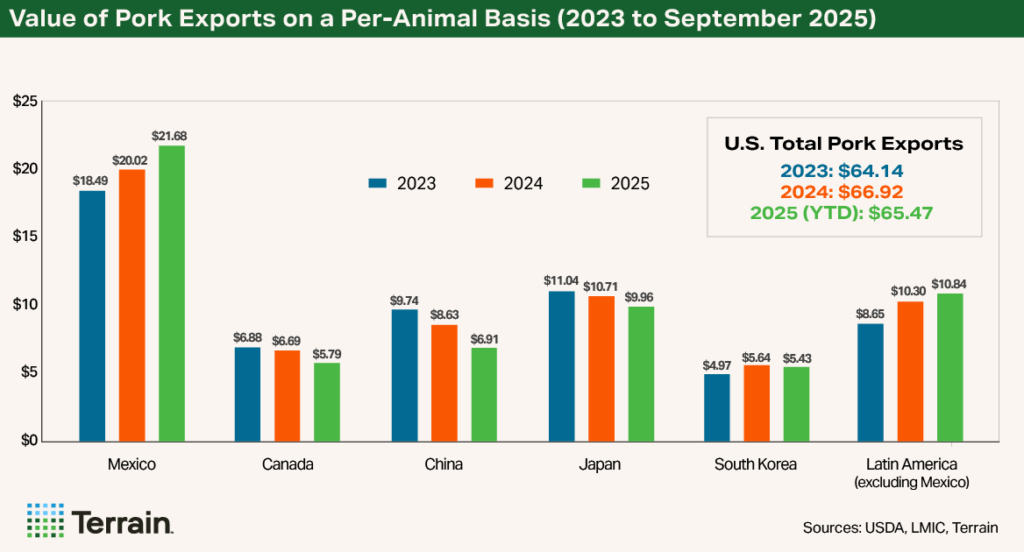

Through September, total U.S. pork exports were down about 3.2% from 2024’s record pace, totaling roughly 2.2 million metric tons (MMT).

U.S. pork exports remain resilient, supported by growth in Latin America and steady overall demand.

Latin American countries, particularly Mexico, remain vital trading partners for the U.S. pork industry. From January to September, exports to Latin America rose 6% YOY, helping offset declines in other regions.

Over the same period, exports to Mexico increased 4.5% to approximately 0.89 MMT, accounting for 41% of total U.S. pork exports. Mexico’s strong demand underscores its role as a cornerstone market for U.S. pork.

Meanwhile, YTD exports have declined in several key destinations: Canada (-16%), Japan (-9%), China (-18%) and South Korea (-7%). Despite these setbacks and ongoing trade uncertainties, U.S. pork exports remain resilient, supported by growth in Latin America and steady overall demand.

Over the past three years, U.S. pork exports have demonstrated remarkable consistency, as reflected in export value per head slaughtered: $64.14 in 2023, rising to $66.92 in 2024 and settling at $65.47 through September 2025. Compared with last quarter’s outlook, YTD export value per animal has increased to Mexico (from $20.90 to $21.68) and Canada (from $5.53 to $5.79), while slight decreases were recorded in China, Japan, South Korea and broader Latin America. This modest decline points to some softening in export momentum, likely driven by trade uncertainty, intensifying global competition, and shifting demand dynamics.

A significant development has emerged in global pork markets during the fourth quarter: Spain has confirmed African swine fever (ASF) in wild boars in Catalonia, near Barcelona. This is the country’s first ASF detection in more than three decades, with the last case reported in 1994.

The timing is critical given Spain’s scale in the industry. Eurostat data show that in 2024, Spain held the largest swine herd in the EU, with roughly 34.6 million head, including over 2.6 million breeding sows. Production from January through September reached nearly 3.9 MMT, a gain of about 7% from the prior year, while exports approached 1.9 MMT, up around 1%.

China has been a major buyer of Spanish pork, making the outbreak particularly sensitive. Already, Beijing has restricted imports from affected regions. Should ASF spread from wild boars into Spain’s commercial herds, broader restrictions from China and other destinations are likely.

Spain does have regionalization agreements with partners such as the U.K., South Korea and China, which may allow some trade from unaffected zones, but the situation remains highly uncertain.

The immediate effect could be a potential reordering of global trade flows. Countries that depended on Spain may turn to other suppliers, opening the door for U.S. producers to capture additional demand. As the world’s largest pork exporter, the U.S. is well-positioned to step in, with stronger overseas demand potentially supporting domestic prices if European supplies remain disrupted.

Overall, Spain’s ASF challenge could strengthen U.S. pork’s global position.

Global pork prices could face upward pressure if buyers adjust to reduced Spanish availability. For U.S. producers, this could improve competitiveness, especially as disease-free status becomes a priority. Still, volatility is likely as governments update import rules, evaluate Spain’s containment measures, and respond to shifting biosecurity risks.

It is important to note that ASF in Spain does not affect the health of the U.S. herd or domestic supply directly. However, it makes it much more important to emphasize biosecurity protocols and measures. The episode reinforces the importance of strong U.S. biosecurity systems to keep ASF out of domestic production.

Overall, Spain’s ASF challenge could strengthen U.S. pork’s global position. The scale of this benefit will depend on policy responses, market adaptability and the duration of Spain’s disruption. Trade tensions with Mexico and China remain a key risk, but if Spain’s ASF situation persists, U.S. producers may find meaningful upside in 2026.

Cutout Values Hold Their Premiums

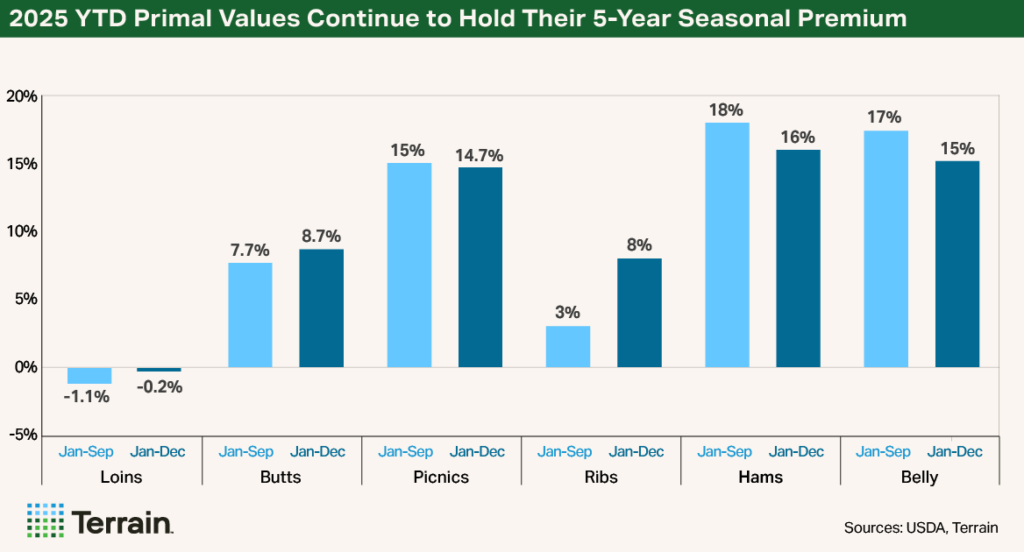

Weekly carcass cutout values have declined steadily since mid-September, continuing through the fourth quarter. The downturn has been largely driven by sufficient product availability and softer domestic demand that generally occurs seasonally.

Even so, the pork cutout in early December remained above $94/cwt, holding an 11% premium to its five-year seasonal average and a 17% premium to the 10-year average. There’s even a 4.7% premium compared with the historical value seen during the first part of December last year.

Looking at the five- and 10-year averages, the pork cutout typically stabilizes between Thanksgiving and Christmas. In my previous swine quarterly, I noted that a December cutout near $93/cwt could be sustained if YTD (January through September) primal values continued to hold their premium over each primal’s five-year average.

With a few more months of data now available, loins, butts and ribs have further strengthened their YTD (January through early December) premiums against their five-year average cutout value, while picnics, hams and bellies have shown only modest weakness. Although seasonal factors have led to an overall decline in primal values, the average YTD premium across most primals compared versus their five-year average has remained intact.

However, there’s more downside than upside as we finish 2025. With a shortened schedule between Thanksgiving and Christmas and with weights continuing their seasonal increase, this will put downside pressure on the cutout.

Following their seasonal trends, I expect bellies and loins to have more of a softer tone and ribs, butts and hams to have more of neutral tone as we wind down 2025. The USDA’s cold storage report will be an important one to monitor to determine how much product is currently in stock.

Based on my cutout and national cash forecasts, I project the monthly average implied lean hog index to start Q1 in the low $80s and rise into the upper mid-$80s by the end of the quarter.

Three Considerations for 2026

1. Build Financial Resilience

The hog industry enters 2026 from a position of strength, but cycles can be stubbornly long. Strengthen liquidity and working capital buffers to weather volatility. Run stress-test scenarios on cash flows to evaluate “what-ifs.” For example, what would a 10% decline in hog prices combined with a 10% increase in feed costs do to my breakeven? This situational awareness enhances adaptability and helps safeguard annual profitability.

Hog profitability in 2026 is expected to be slightly lower than in 2025, making disciplined margin management critical.

2. Lock In Margins, Not Just Prices

With hog futures seasonally strong and feed costs lower, forward margins remain favorable. However, hog profitability in 2026 is expected to be slightly lower than in 2025, making disciplined margin management critical. Avoid complacency in risk management. Focus on deferred contracts and collaborate with marketing advisers and Farm Credit insurance to secure profits as far forward as market conditions and policies allow.

3. Remain Flexible and Responsive to Evolving Fundamentals

Key factors to monitor in 2026 include herd health risks, feed cost volatility and export demand — particularly developments in Spain’s ASF situation and China’s import needs. Tariff and trade uncertainty with Mexico persists, although tensions have been momentarily dialed down. Domestic demand trends, hog weights and packer capacity will also shape markets. Prioritize herd health, secure feed when opportunities arise, and use futures or options to protect margins.

Appendix (Crush Margin, Next 12 Months)

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.