Agricultural outlook for Q1 2025 from Terrain™, our service for agricultural insights. Author Matt Clark is Terrain’s senior rural economy analyst, focusing on the impacts of interest rates, land values and other macroeconomic trends on agriculture. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation

The Federal Reserve has cut interest rates for the first time since 2020. However, the central bank is keeping a close eye on the economy and may not continue to cut rates as quickly as some had expected.

Outlook

For farmers and ranchers, interest rate costs in 2025 should be modestly lower than a year ago.

Impact

A best practice in this environment is to have an interest rate plan like a commodity marketing plan, and to consider all your interest rate and loan structure options when planning for a farmland or equipment purchase.

Stronger-than-expected economic growth amid poorer consumer sentiment. Geopolitical tensions fueling multiple regional wars. A change in the White House. A change in the Senate majority. Somewhat sticky inflation alongside a marginally higher savings rate. A host of other uncertainties, juxtapositions and paradoxes.

That’s what the U.S. economy is facing, and it’s easy to sympathize with Federal Reserve Chairman Jerome Powell’s comment at the November 7 press conference of, “We don’t guess, we don’t speculate, and we don’t assume.”

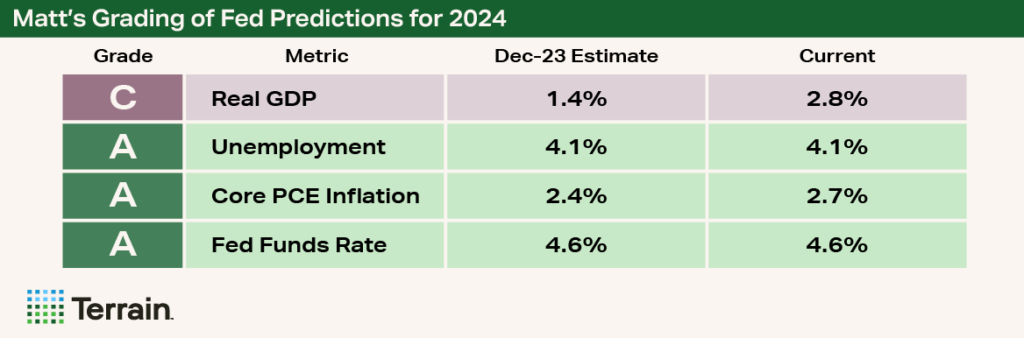

Ironically, in December 2023, Federal Open Market Committee (FOMC) members very accurately speculated, guessed and assumed what type of economic conditions 2024 would bear, otherwise known as the dot plot. In the FOMC’s December 2023 dot plot, their estimates for 2024 unemployment, inflation and the federal funds rate are nearly spot-on despite underestimating gross domestic product (GDP) growth.

The pace of inflation has moderated enough that the Fed cut the federal funds rate by 25 basis points on November 7.

So far, the stronger-than-expected economic growth has not reignited inflation substantially. The pace of inflation has moderated enough that the Fed cut the federal funds rate by 25 basis points on November 7, bringing the volume of total cuts in 2024 to 75 basis points. For context, every 100-basis point, or 1%, cut in the fed funds rate saves about $1,000 of interest on a $100,000 loan with a single-year payout.

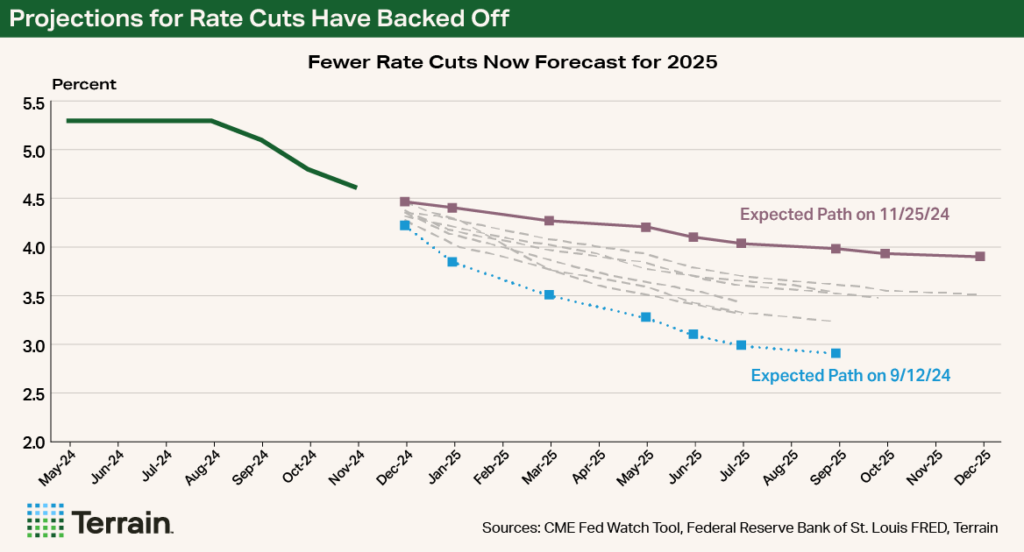

Looking forward, however, market expectations of the federal funds rate have moved substantially higher (meaning fewer projected Fed rate cuts in 2025), as the economic data continue to point to above-trend growth. Powell added fuel to the fire when he commented on November 14 that “the economy is not sending any signals that we need to be in a hurry to lower rates.” As of November 25, the market expected the fed funds rate in September 2025 to be near 4%, more than a full percentage point higher than expectations just two months ago.

However, market expectations of the federal funds rate have moved substantially higher (meaning fewer projected Fed rate cuts in 2025).

For farmers and ranchers, variable interest rates likely moved, or will move, slightly lower with the most recent Fed rate cut. However, the expectation that variable rates will move significantly lower has dimmed, meaning interest rate costs in 2025 should be lower than a year ago but not significantly.

Interest rates on longer-term assets will likely remain elevated in the near future, though slightly down from year-ago levels.

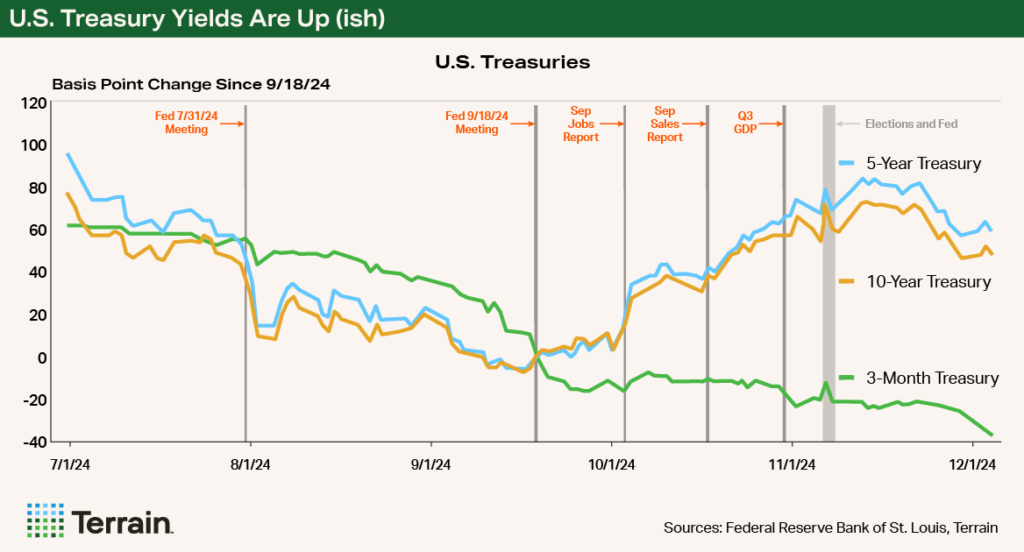

Likewise, yields on longer-term Treasuries have moved higher alongside positive economic news and concerns over longer-term inflation and government deficits. As yields on longer-term Treasuries move higher, interest rates for loans on longer-term assets such as farmland tend to move higher as well. For farmers and ranchers, this implies that interest rates on longer-term assets will likely remain elevated in the near future, though slightly down from year-ago levels.

Any further interest rate relief will depend on the general health of the U.S. economy and, specifically, the Fed’s dual mandate for economic health.

As agriculture heads into a period of renewals, land auctions, taxes and general financial planning, interest rates will likely be a hot topic with accountants, brokers and Farm Credit lenders. Any further interest rate relief will depend on the general health of the U.S. economy and, specifically, the Fed’s dual mandate for economic health: Maintain stable prices and maximum employment.

Inflation

Stronger-than-expected economic growth has not yet reignited inflation, but inflation has been above the Fed’s stated goal of averaging 2%. However, consider Powell’s comment on inflation during the November 7 press conference:

“We are not on any preset course. … If the economy remains strong and inflation is not sustainably moving toward 2%, we can dial back policy restraint more slowly.”

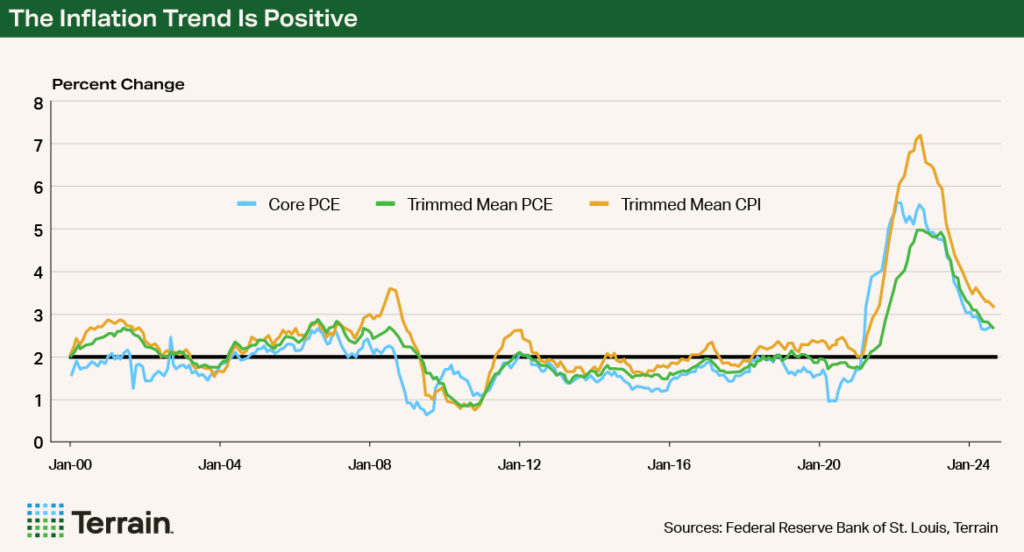

Clearly, the Fed is watching inflation with a hawkish eye. Over the past several months, most inflation metrics have trended downward or increased at a slower rate. Both the trimmed mean consumer price index (CPI) and personal consumption expenditures (PCE), which trim off the fastest- and slowest-moving items, have steadily shown improvement in nearly every month of 2024. Other metrics such as core CPI and PCE, which trim off just food and energy, have flattened and in some cases moved slightly higher.

If economic growth remains strong and the consumer continues to spend, there is danger that inflation could remain sticky. Consecutive months of flat or increasing inflation would certainly give the Fed pause in cutting further.

Labor

The labor market had also been on a path of strength for much of 2024, but some recent signs of weakness have caused the Fed to ease monetary policy. For example, the level of total private employees had increased for 45 consecutive months dating back to January 2021; however, lackluster job growth in October brought the trend to a stop.

However, given the strong November jobs report, it appears that the October job situation was a result of hurricanes and labor strikes. Regardless, the Fed is clearly focused on keeping an accommodative labor market. Again, consider Powell’s comment at the November 7 press conference:

“We don’t want the labor market to soften much from here. We don’t think we need that to happen to get inflation back to 2%.”

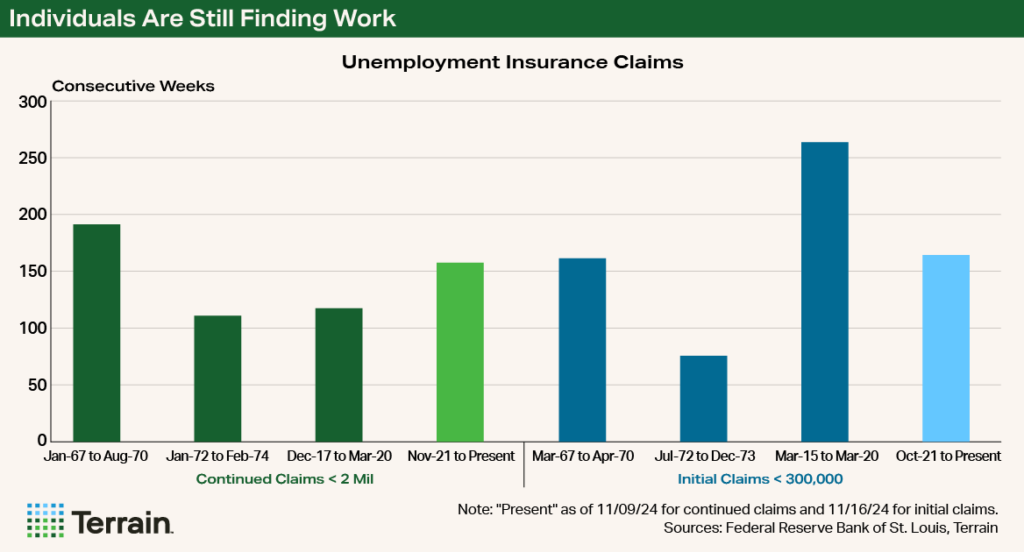

Looking forward, it seems unlikely that the labor market will sharply contract. Some indicators such as announced layoffs indicate some softness. But overall, unemployed numbers remain historically low, indicating a still-robust job market that may slow the pace of Fed interest rate cuts.

Price Rates Like Your Commodities

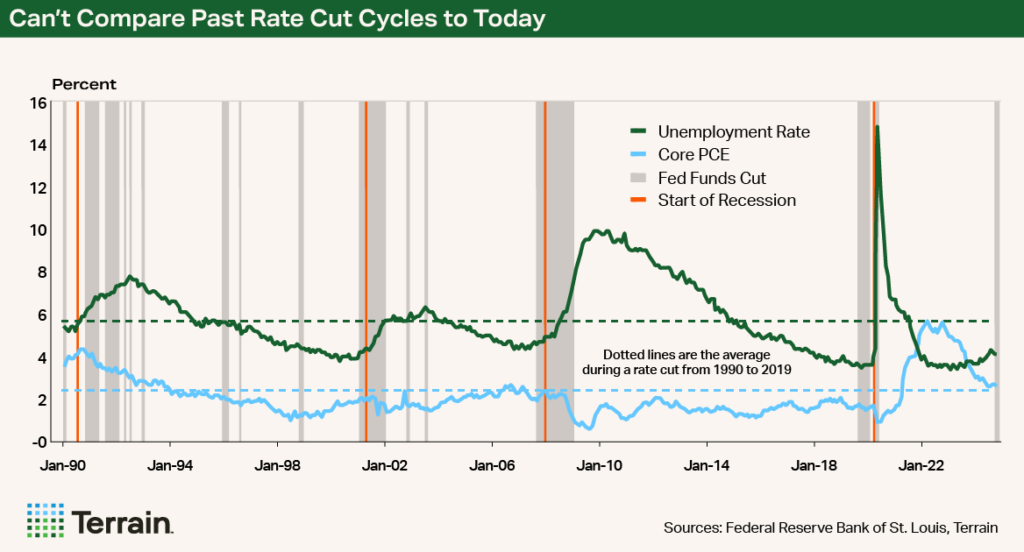

I believe that it is important to take the Fed members at their word: They are not on a set interest rate path, and they will remain data-dependent. Trying to make comparisons to past economic regimes also seems foolhardy, as the current levels of inflation and unemployment are not consistent with past periods of rate cuts.

A best practice in this environment is to have an interest rate plan like your commodity marketing plan.

A best practice in this environment is to have an interest rate plan like your commodity marketing plan. Work with your Farm Credit lender to stress-test your financial performance at different interest rates and have a plan for when to lock, when to remain variable, or when to refinance should interest rates move sharply in one direction.

If you are planning to purchase farmland or equipment, consider all your interest rate and loan structure options, as different products may have significantly different cost.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.