Agricultural outlook for Q3 2025 from Terrain™, our service for agricultural insights. Author Ben Laine is Terrain’s senior dairy analyst. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation:

Surprisingly strong butter exports alongside consistent domestic demand have rebalanced dairy markets.

Outlook:

Given current forecasts for feed prices, dairy margins should stay in profitability.

Impact:

Most of the potential risk is on the demand side, particularly with exports, though that risk has diminished from last quarter.

Early this year, dairy markets were shaky due to fears of trade disruptions. While we’re not out of the woods yet on trade, the path ahead is looking clearer. Through April, cheese export volumes are up more than 8% year-on-year (YOY) after adjusting for the 2024 leap year. Butter exports are up an impressive 179%.

Strong Domestic and Export Demand

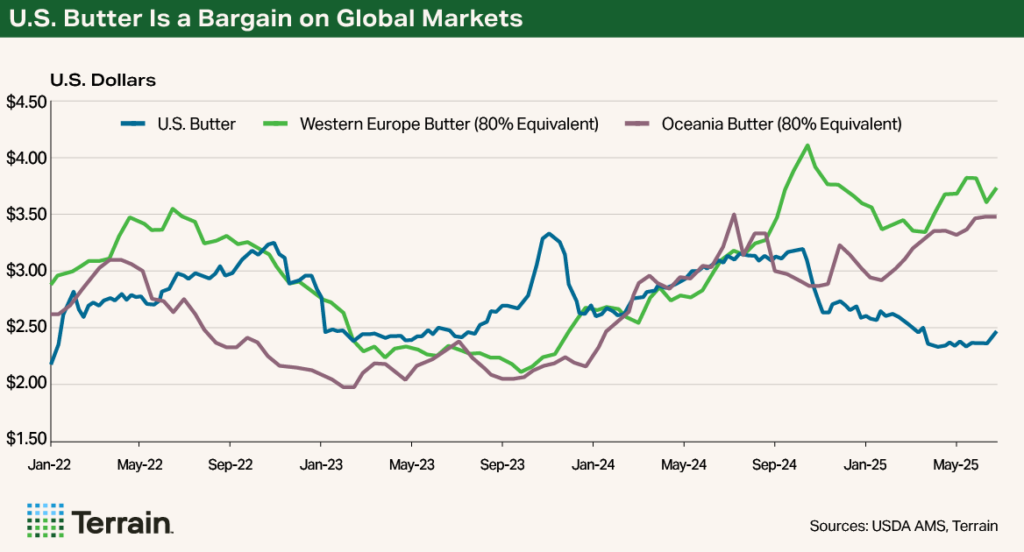

In most years, butter exports from the U.S. are negligible since it is highly valued domestically and butter for the domestic market is made to different specifications than what international markets seek. This year, however, ample cream and high international prices have led to a huge gap between the U.S. and world price for butter, opening the door for opportunistic butter export sales.

While cheese prices are not experiencing the same magnitude of a discount to world markets, cheese is still priced favorably and has enjoyed continued export volume strength.

Amid the strong butter exports, ice cream season and school breaks, cream markets have normalized compared to the heavy surplus earlier in the year. Butter prices increased when reports of butter production increasing 9% YOY in March were countered by a Cold Storage report showing inventories falling by 7% in April. Those reports reassured markets of the strong demand in both domestic and export channels.

Domestic demand also maintained steady footing across the first quarter with demand up 2.2% YOY for total milk solids. Butter demand was up 3.5% YOY while American cheese was up 0.2% and other cheese fell by 1.1%.

More Milk Production and Processing Investment

Announcements of new processing plant investments continue to roll in. Among these, Chobani is building a large new facility in Rome, N.Y., and Bel Brands is expanding in Brookings, S.D. These new plants won’t take milk until 2027, but the investment announcements on top of ongoing plant openings are an encouraging sign for continued strong dairy demand.

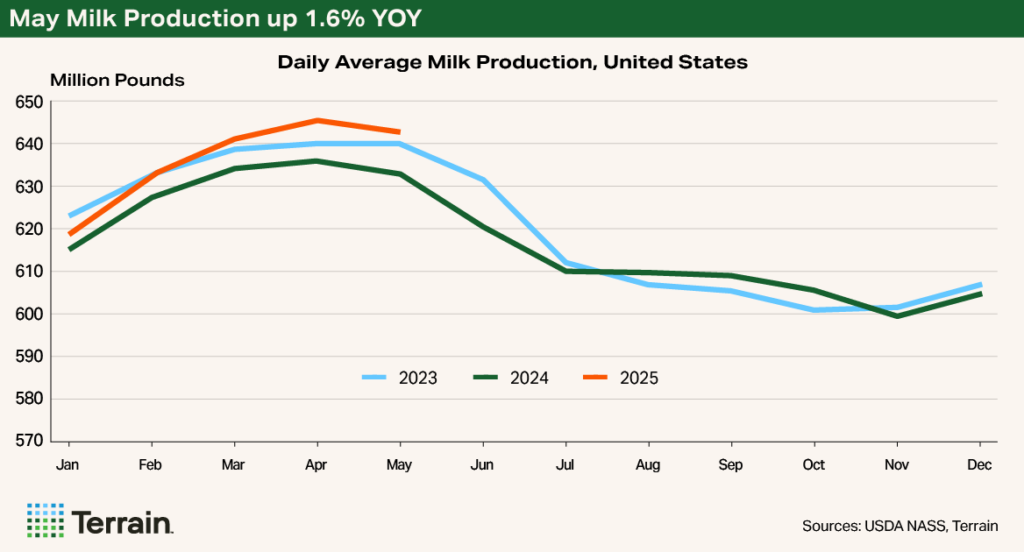

Producers are demonstrating that, despite the headwinds to dairy herd expansion (including beef-cross calf prices that continue to climb to new heights), they are managing to expand the herd and drive milk production into growth territory. In May, there were 9.45 million milk cows in the U.S., which is up 114,000 head from a year ago. Milk production climbed by 1.6% YOY in both April and May.

Federal Order Changes and Price Projections

Alongside the normal, market-driven price movements are changes to Federal Milk Marketing Order (FMMO) price formulas. Most of the pricing changes took effect June 1, 2025, with a delayed implementation of updated skim milk component values coming Dec. 31, 2025.

While a USDA analysis projects total pool value to increase slightly, published component and classified prices likely will see decreases. This will impact the basis between mailbox milk prices that producers receive and the Class III and IV milk price instruments they may be using to manage their risk. More detail can be found in the recent Terrain report “New Federal Milk Marketing Order Rules Now Effective.”

For the second half of 2025, I project price averages of $18.10/cwt. for Class III milk and $18.50/cwt. for Class IV milk. This represents about a 50 cent increase in the Class III projection and 40 cent decrease in the Class IV projection compared with the previous forecast.

All dairy commodities should have ample supply, and most of the potential risk is on the demand side, particularly with exports, though the urgency of that risk has diminished from last quarter. My preliminary projection for the first quarter 2026 is for $17.10/cwt. For Class III and $18.00/cwt. for Class IV, including a slight increase due to updated skim component factors that will take effect Dec. 31 in FMMO pricing formulas.

Milk-to-feed margins as calculated for the Dairy Margin Coverage program are expected to remain high for the remainder of the year based on current futures prices. For the remainder of 2025, Dairy Margin Coverage margins are projected to average $13.07/cwt., well above the maximum $9.50 coverage level. This is good news for profitability, but it also means there is a low likelihood of any indemnity payments from the program this year.

Still, looking for opportunities to protect margins or manage risk remains prudent given the possibility of unforeseen disruptions that may result in lower prices or lower income-over-feed-cost margins.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.