Article published on TerrainAg.com. Author Marc Rosenbohm is Terrain’s senior grain and oilseed analyst.

Background

On December 21, 2024, Congress passed the American Relief Act of 2025, authorizing up to $10 billion in economic assistance to producers and about $20 billion in disaster assistance to farmers facing losses from natural disasters and related events. Only the $10 billion portion for economic assistance, known as the Emergency Commodity Assistance Program (ECAP), is considered in this report. Implementation is still pending for the other $20 billion.

ECAP is intended to help farmers manage the impact of increased input costs and falling commodity prices.

ECAP is intended to help farmers manage the impact of increased input costs and falling commodity prices. Congress gave the USDA a 90-day deadline to roll out the $10 billion in economic assistance. That deadline was March 21, 2025. The final rules were released on March 19, 2025, just ahead of the deadline.

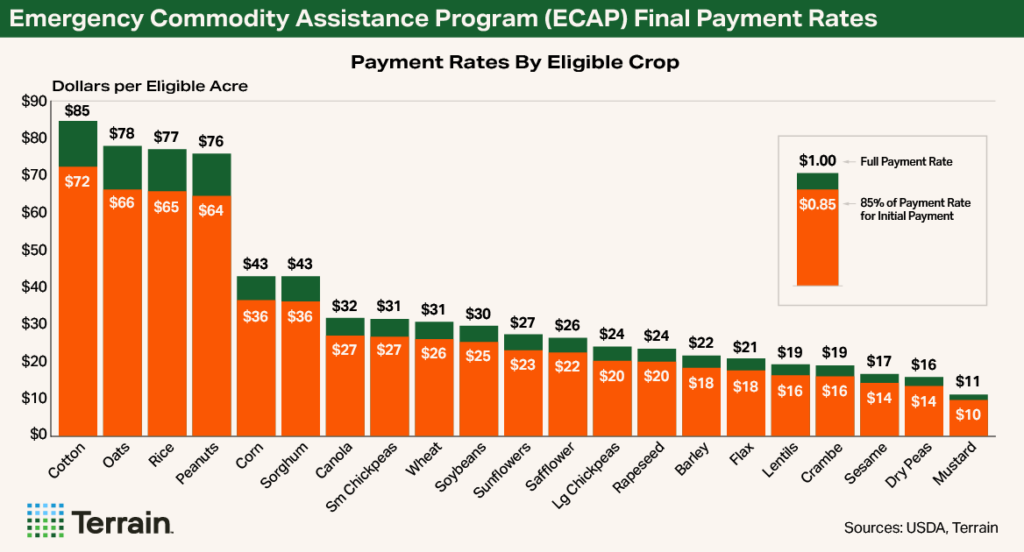

In a prior article, Terrain estimated the average payment rate for each of the major crops as well as the average payment rate that each state could expect for this economic assistance. For almost all the major crops, those initial estimates are close to the final payment rates announced by the USDA.

Summary of Final Rules

The following are important details of the program that farmers should know:

Payments Are Prorated Initially

The $10 billion of funding allocated for this economic assistance is a maximum amount that can be spent. To ensure that money gets distributed quickly and the USDA does not exceed this cap, the initial payment will be prorated. The first payment for 85% of a farmer’s eligible amount will be made relatively quickly after application. The remaining amount, which could be prorated if total program payment claims exceed $10 billion, will be made after the program application period closes on August 15, 2025.

Applications Based on Previously Reported Acreage

Farmers will receive a prefilled ECAP application that can be submitted either to their local Farm Service Agency (FSA) office or online. These forms will be prepopulated with a farmer’s previously reported 2024 planted acres of eligible commodities and 50% of a farmer’s 2024 prevent plant acres of eligible commodities. Generally, the FSA will not allow adjustments to prefilled acreage data on this form; however, there are some exceptions.

Maximum Payment Limits

Payment limits of either $125,000 or $250,000 will apply to these payments based on the share (over or under 75%) of average gross income derived from farming, ranching or forestry activities between 2020 and 2022, and are separate from payment limits for other programs.

Payments are made on reported acreage of eligible commodities that were either planted or prevented from being planted.

Eligible Acres

Payments are made on reported acreage of eligible commodities that were either planted or prevented from being planted. Importantly, acreage of either category can still be reported to the FSA and be eligible for payments as long as reported before the August 15, 2025, program deadline.

- Acreage that has been reported with both an initial commodity and a double crop commodity will be eligible for payment on both plantings if in an approved double cropping combination.

- Acreage that has multiple intended uses will only be eligible for payment on one intended use. If multiple producers have interest, the payment is limited to the applicant that has the interest in input expenses.

- Producers will be eligible for payment on both plantings in situations where producers graze small grain acreage and then still could timely plant a spring commodity with a reasonable expectation to produce a normal yield, therefore making use of both commodities if there is a Risk Management Agency short rate policy in effect for 2024.

- In cases where an initial eligible commodity failed or was prevented from being planted and the producer planted a subsequent eligible commodity for the 2024 crop year, eligible acreage will be limited to the initial crop if not in an approved double crop combination.

- Volunteer acreage, experimental acreage, and acreage with an intended use of green manure or left standing are not eligible for payment under ECAP.

Calculating Payments

Payments are calculated as the flat payment rate for the eligible commodity multiplied by the eligible reported acres, added up across all eligible commodities. Eligible acres are generally 100% of reported planted acres plus 50% of prevent plant acres in 2024.

There is a payment estimate tool available from the FSA with the payment rates prefilled by eligible commodity: https://www.fsa.usda.gov/ecap/payment-calculator.

Our table shows the final payment rates as determined by the USDA. In general, all the payment rates for the crops where there was not an important determination needed from the secretary of agriculture were close to Terrain’s initial estimates.

For a detailed table of how the final payment rates were determined, see Table 3 in the Federal Register Notice.

Timely Assistance Expected

From a cash flow perspective, 85% of a farmer’s total amount will be available soon after their application is submitted. Payments will be issued as applications are approved. This will help infuse cash into the farm economy as planting of spring crops is underway in parts of the U.S. or will be soon in other parts.

The remainder, if any, will likely arrive after August 15, 2025, after the full amount of all claims is known and the remaining amounts can be prorated to ensure the overall program spending remains at or under the $10 billion legislated maximum.

Based on my analysis of official payment rates, FSA January acreage data, National Agricultural Statistics Service acreage estimates, and program rules, overall prorating is likely to be small, if it happens at all. However, this reduction could be larger than I currently expect if a significant number of acres that were previously unreported become reported and eligible for payments throughout the application process.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.